Small to Medium Enterprises (SMEs) primarily use the SME or new ERIS Scheme for their R&D Tax Relief claims when they have funded the project themselves; however, there are some occasions where a SME needs to use the RDEC (Research and Development Expenditure Credit) Scheme.

The SME and ERIS Schemes are certainly more generous – returning between £9 to £33 per £100 spent, depending on profit (loss) and the period you are claiming – but there are some circumstances in which a SME is simply unable to claim via the SME scheme. These include:

SMEs can claim under the RDEC or New RDEC for these types of projects.

The RDEC scheme is primarily aimed at large UK companies with over 500 employees. Like the SME Scheme, it offers tax relief on the money a business has invested in research and development activities.

The New RDEC replaces the SME and the RDEC scheme, which will allow for all companies regardless of size to claim for self-funded projects.

Before 1st April 2023, the RDEC Tax Relief rate was 13%, and post this date the rate increased to 20%. This means that after tax, a company can receive between £10.53 and £16.20 for each £100 spent on qualifying R&D. The table below shows how this is calculated:

| RDEC Rates | Pre 1st April 2023 | Post 1st April 2023 |

| R&D Eligible Costs | £100 | £100.00 |

| Gross RDEC | £13.00 | £20.00 |

| Net RDEC less 19% tax | £10.53 | £16.20 |

| Net RDEC less 25% tax | N/A | £15.00 |

If a SME company has undertaken an R&D project which was funded through a grant or subsidy, a government organisation or foreign company then the SME Scheme does not allow a claim to be made against the grant funded project. The RDEC Scheme and New RDEC Schemes, however, does allow such a claim. The New RDEC scheme also allows an SME to claim for contemplated R&D from another SME.

Most grant funding is only for a percentage of a project’s costs. For example, a project that is 70% funded, means that the remaining 30% is match-funded, usually by the SME company.

Under RDEC, a company receiving a Notified State Aid Grant* may be able to claim against the entire project costs for eligible expenditure on items such as materials, consumables, staff, research institutes (Universities typically), and Externally Provided Workers (EPWs). If the grant is Non-Notified State Aid* (often De Minimis) then the company may also be able to claim via the SME or ERIS schemes for the 30% self-funded portion, with 70% of eligible costs claimed through the RDEC scheme.

*Please Note: this is to be considered on a case-by-case basis due to State Aid rules.

Businesses of all sizes will very often subcontract work to specialists, who carry out R&D on their behalf. This is especially common when a business does not have the required skills or facilities in-house. Examples of commonly subcontracted activities include software development, design work, computational analysis, or laboratory/bench tests.

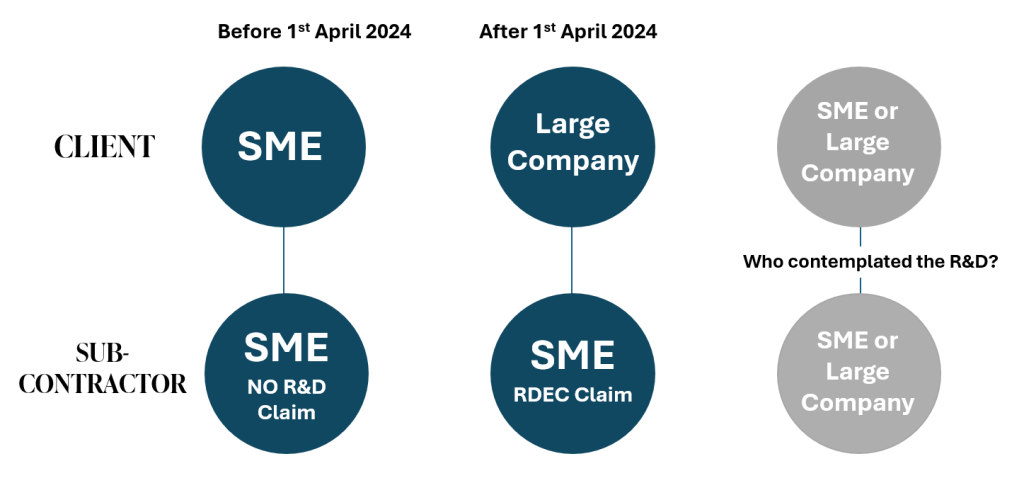

If a SME is subcontracted by another SME client, then the client will usually make a claim for those R&D activities via the SME Scheme before 1st April 2024.

However, if an SME is subcontracted by a large company client, then the SME can only make a claim via the RDEC Scheme for their eligible expenditure. So the SME sub-contractor has been paid to carry out the R&D, maybe made a profit on this, but can still claim through the RDEC relief scheme.

After 1 April 2024 an SME sub-contracting R&D from one SME to another SME, it will be the SME that contemplated the R&D that will be able to make the R&D claim.

Please Note: This will need to be considered on a case-by-case basis due to ownership of IP and R&D. The question of who contemplated the R&D is relevant to claims after 1st April 2024.

In the first instance, we urge SMEs to check their eligibility and make a claim via the SME or ERIS Schemes as it’s the most beneficial at up to 33% or 27% tax relief depending on the period claimed. If for any reason you’re unable to claim, then RDEC is not just for SMEs and should be considered!

There are many intricacies to both the SME, ERIS and RDEC Schemes. Our advice is to consult an R&D Tax expert if you’re a SME wanting to claim via these schemes to ensure eligibility.

If you’d like to discuss using any of the R&D relief schemes as a SME, our consultants would be happy to speak to you to decipher your eligibility and your potential claim value! Contact us here.