Ian Davie

Senior Consultant

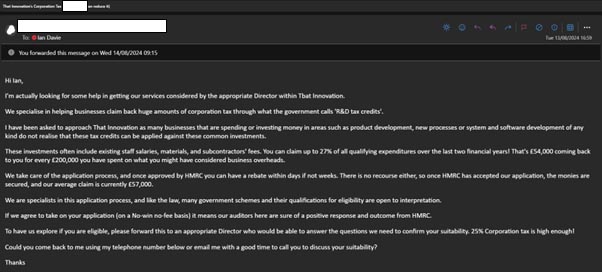

Occasionally I or others at TBAT Innovation get emails or cold calls from other R&D tax credit providers, and where I can I follow these up for a little competitor analysis. Last week I received an unsolicited email asking if I wanted support for an R&D claim entitled “That Innovation’s Corporation Tax (###### #### can reduce it)”.

Firstly, the company got TBAT Innovations’ name wrong which is not a great start and secondly, as you’ll see in this blog, there were a few other things this company got wrong, too. The company name has been redacted for confidentiality reasons (and I don’t want to be sued) but I would be happy to stand up and defend my views.

The email starts off “We specialise in helping businesses claim back huge amounts of corporation tax through what the government calls ‘R&D tax credits’.” Interesting, I would like to find out more but correct so far.

It then goes on to say, “I have been asked to approach That Innovation as many businesses that are spending or investing money in areas such as product development, new processes or system and software development of any kind do not realise that these tax credits can be applied against these common investments.” Several points on this statement:

Further on, the email states, “We are specialists in this application process, and like the law, many government schemes and their qualifications for eligibility are open to interpretation.” While I agree there are issues of interpretation present between HMRC and claimants on specific areas of R&D (See First-Tier Tribunal Case Summary) I don’t think it is good to use this as a marketing R&D catch-all approach.

The email states “These investments often include existing staff salaries, materials, and subcontractors’ fees. You can claim up to 27% of all qualifying expenditures over the last two financial years! That’s £54,000 coming back to you for every £200,000 you have spent on what you might have considered business overheads.”

Yes, a claim rate of 27% is possible, but only if you are one of 10,000 businesses that are loss-making research-intensive SME’s (Small to Medium Enterprise) that are cashing in losses. This is a marketing ploy to tempt companies with the largest possible benefit, which although feasible, there are many other factors which need to be considered when making an R&D tax claim, such as the scheme used, the company size, profitability and how the project is funded which could result in anywhere from an 8% to 33% benefit, for example:

In reality, there is quite a variation of possible benefit outcomes, it is not a straightforward blanket approach which has been implied here (and is arguably quite misleading).

The email goes on to say “We take care of the application process, and once approved by HMRC you can have a rebate within days if not weeks. There is no recourse either, so once HMRC has accepted our application, the monies are secured, and our average claim is currently £57,000.”

Now this is the line that really got my goat as it is the most factually incorrect part! Let’s break this down phrase by phrase.

“…once approved by HMRC…” is a phrase actively discouraged by… HMRC! Payment of an R&D claim by HMRC does not mean that it has been approved. Yes, the payment has been processed but the R&D tax claim itself has certainty not been approved. HMRC are well within its rights to open an enquiry into an R&D tax claim even if the payment has already been processed.

“…rebate within a few days…”, is highly unlikely. The target processing time for HMRC is 40 days from submission with a further 2 weeks for any repayment, so realistically you are looking at 8 weeks, NOT a few days. If a payment is made within two weeks this is not only a surprise but is considered an anomaly against the standard processing times. As always, TBAT communicates 8 weeks to any client making an R&D claim.

“There is no recourse either, so once HMRC has accepted our application, the monies are secured”.

Now this is just a plain lie. This marketing statement is incredibly misleading as the wording “..no recourse..” implies HMRC cannot change their mind. Anyone who works in the R&D tax industry, will of course know, that this is not the case. HMRC opens compliance checks on 20% of R&D claims submitted. This, therefore, renders the final statement “the monies are secured” redundant as it is total rubbish (for lack of a better word!).

All in all, the above points demonstrate that if a marketing email sounds too good to be true, it probably is. Don’t be tempted by high values, big returns and no risk. Ask around and get a recommendation of a good R&D tax specialist to talk to that will give you an honest assessment. With this in mind, if you would like to speak to an R&D tax consultant, you can book a free 1-2-1 consultation with me here.

With HMRC now questioning claimants about the process that went into selecting the R&D tax specialists who worked on the claim, it is important to make sure you’re getting good, honest and accurate advice. If not, a compliance check may well be opened and potential penalties applied if using companies such as this. In other words, buyers beware!

I have passed the email on to HMRC, given it is factually incorrect and intentionally misleading. It is companies like these that are giving the R&D tax industry a bad name. If any other companies like this one want to pitch R&D tax to me, I don’t mind but at least get it right!

Our comprehensive 2025 R&D Tax Credits review covers everything businesses need to know, including key developments in R&D tax reliefs, claim trends, compliance updates, HMRC enforcement actions, First Tier Tribunal cases, and changes to schemes like RDEC, ERIS, and Advance Clearance. Explore the impact on SMEs and large companies, insights on eligible costs and foreign subcontractor rules, and what to expect for R&D tax credits in 2026.

An HMRC R&D compliance check can be intimidating, even for businesses doing genuine innovation. This article walks you through what happens during a check, the information HMRC typically asks for, common issues that can arise, and how TBAT Innovation helps businesses respond confidently and keep their R&D tax credit claims strong.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch