Dave Schorah

R&D Tax Team Leader

Due to the amount of money large companies are likely to be spending on R&D – the RDEC Scheme can be extremely beneficial! The Research and Development Expenditure Credit (RDEC) offers Large Enterprises (LE’s) a tax credit incentive of 13% on all qualifying R&D expenditure.

By HMRC definitions, a Large Enterprise is considered a company that has more than 500 full-time employees within the business or group, and either more than €100m turnover or €86m gross assets.

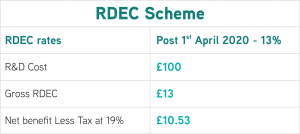

Businesses using the RDEC Scheme can claim 13% in tax relief on eligible R&D expenditure. This means that after Corporation Tax is deducted (as the credit is taxable), a claim is worth £10.53 for every £100 – the table below shows how this is worked out:

All Large Enterprises are eligible to claim the same percentage of tax relief, regardless of whether they’re loss-making or profit-making.

For the Financial Year 2018-19, 3310 claims were made by Large Enterprises using the RDEC Scheme. The average claim value for Large Enterprises was £632,000 and a total of £2.17 billion has been claimed so far.

Large Companies are likely to have an R&D function dedicated to producing new products, processes or services and therefore are likely to be spending large amounts on research and development activities. The total claim value can help fund future R&D investment and bring products or systems to market more quickly.

The benefit received from Large Company Scheme R&D Tax Relief can be accounted for above-the-line on the company’s profit and loss statement, meaning it can improve the profitability of the business’ accounts.

There are a wide range of costs that are eligible to be claimed via the RDEC Scheme, these include:

These costs have to be calculated carefully, ensuring a claim is only made for the proportion used for R&D purposes.

Within Large Enterprises it can be a complex and sometimes difficult task to keep track of R&D expenditure across multiple departments, projects and sometimes multiple businesses within a group.

We work closely with our large clients to identify all eligible expenditure across the business(es) and help to implement methodologies which make the process of claiming in future years much simpler.

In addition, our team work closely with technical staff to build robust evidentiary reports to support maximised R&D Tax claims. Contact us for further information.

Our comprehensive 2025 R&D Tax Credits review covers everything businesses need to know, including key developments in R&D tax reliefs, claim trends, compliance updates, HMRC enforcement actions, First Tier Tribunal cases, and changes to schemes like RDEC, ERIS, and Advance Clearance. Explore the impact on SMEs and large companies, insights on eligible costs and foreign subcontractor rules, and what to expect for R&D tax credits in 2026.

An HMRC R&D compliance check can be intimidating, even for businesses doing genuine innovation. This article walks you through what happens during a check, the information HMRC typically asks for, common issues that can arise, and how TBAT Innovation helps businesses respond confidently and keep their R&D tax credit claims strong.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch