Sam Stephens

Director

It’s that time of year again – HMRC have released their yearly R&D Tax Credit report, detailing the breakdown of the most recent years claims!

Over £35 billion has been spent by businesses all over the UK and identified as being eligible R&D expenditure for claiming R&D Tax Credits. This has resulted in over £5.3 million being paid out to the 57,335 businesses that have made a R&D Tax claim for financial year 2018-19; with the total value estimated to rise to £6.3 billion once all claims have been processed.

Let’s look at a breakdown of both the SME Scheme and RDEC Scheme statistics, looking at how many claims have been made, how much has been claimed and by which industry sectors!

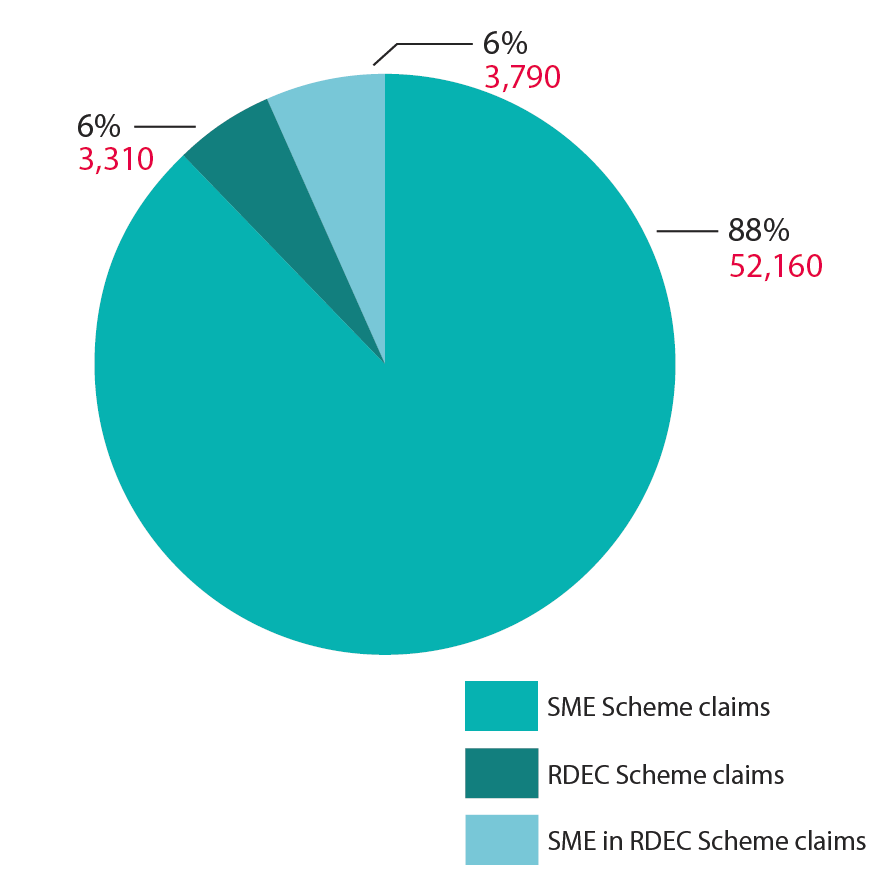

59,265 claims have been made for Financial Year 2018-19 so far; 52,160 of those were made by SME’s into the SME Scheme, 3,310 were made by large companies into the RDEC Scheme, with an additional 3,790 SME claims made a via the RDEC Scheme.

The total amount of claims is due to rise as more claims are made during the 2-year retrospective claim period. In previous years, the number of claims has increased by 17%-20%, meaning the total claims for financial year 2018-19 could be around 70,000!

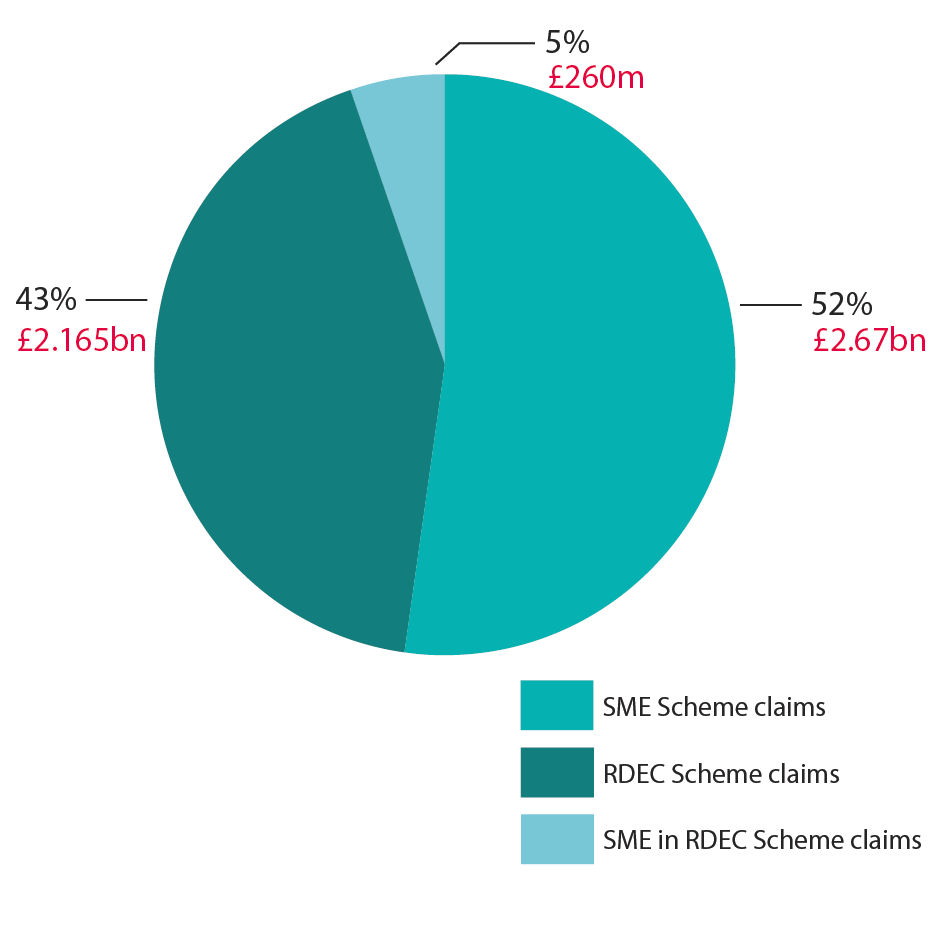

The £5.3 billion of R&D Tax benefit received is split between the same 3 categories:

The £5.3 billion of R&D Tax benefit received is split between the same 3 categories:

Within the current statistics, the average claim for a SME Scheme claim is £57,000 – reflecting a similar average from the previous year.

Large enterprises claiming RDEC benefited £632,000 on average, while SME’s claiming under the RDEC scheme received £68,000.

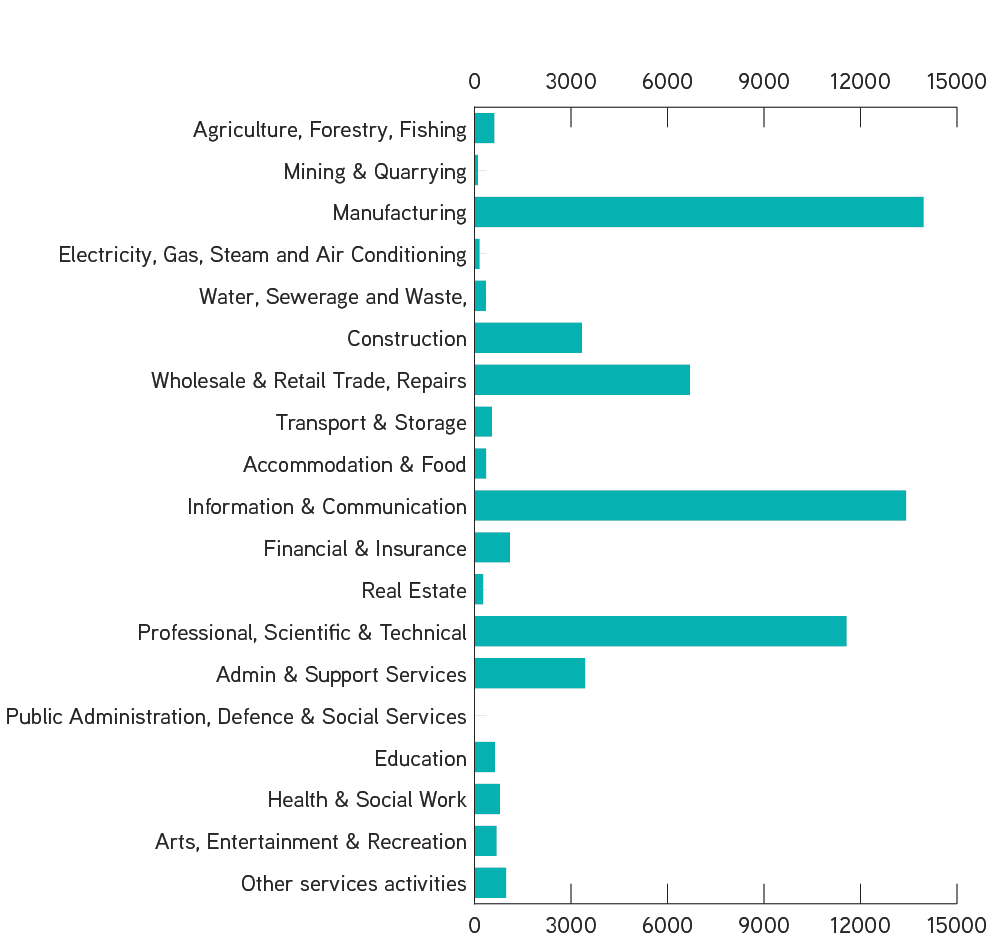

The statistics show that there are 3 industry sectors that have made 67% of the R&D Tax Credit claims for 2018-19:

By claim value, these 3 industries have also claimed a huge 71% of the £5.3 billion tax relief.

Following the top 3, the next 4 largest claimant sectors are:

We’re thrilled to see that so many UK businesses, across a variety of sectors, are recognising the benefit of claiming R&D Tax Credits for the R&D they’ve performed and making the most of both schemes available.

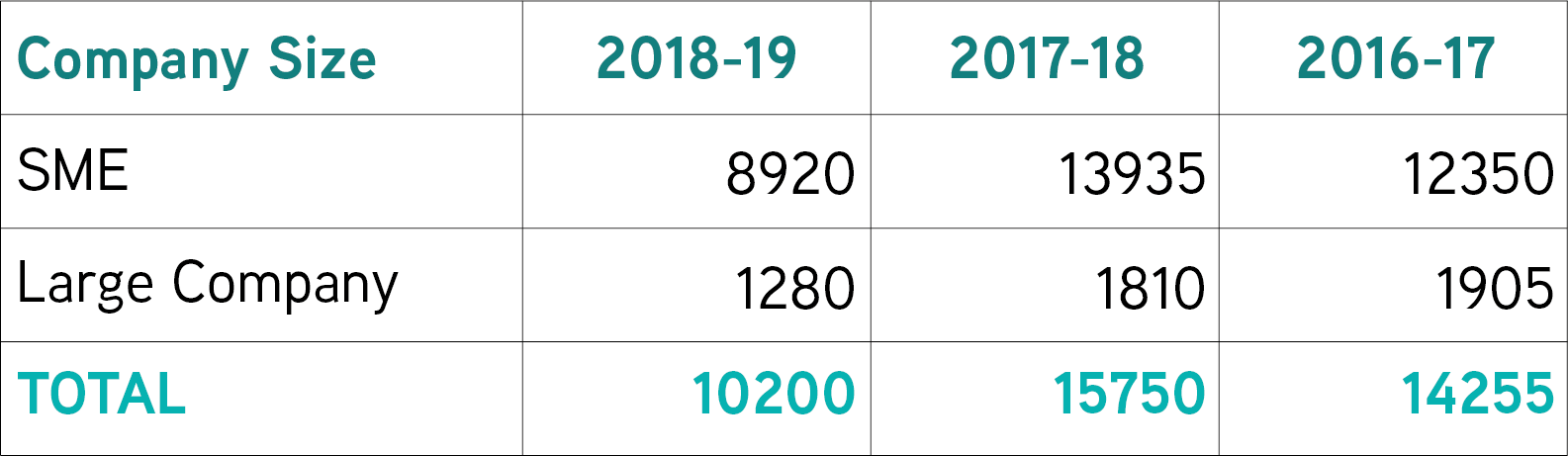

We’re especially excited about the news that 10,200 of the businesses that have claimed for 2018-19 are new claimants, that’s 17.8% of all businesses that claimed!

As with previous years, the number of new claimants is expected to grow as more claims are made. It’s anticipated that the total will reflect the growth from previous years.

With an increasing number of businesses claiming R&D Tax Relief, year-on-year, which is expected to continue, now is the perfect time to check whether your company is also eligible to make a claim.

You can check how much your claim could be worth, by using our online R&D Tax Credit Calculator!

Alternatively, you can get in touch with us here, or using the form below.

Our comprehensive 2025 R&D Tax Credits review covers everything businesses need to know, including key developments in R&D tax reliefs, claim trends, compliance updates, HMRC enforcement actions, First Tier Tribunal cases, and changes to schemes like RDEC, ERIS, and Advance Clearance. Explore the impact on SMEs and large companies, insights on eligible costs and foreign subcontractor rules, and what to expect for R&D tax credits in 2026.

An HMRC R&D compliance check can be intimidating, even for businesses doing genuine innovation. This article walks you through what happens during a check, the information HMRC typically asks for, common issues that can arise, and how TBAT Innovation helps businesses respond confidently and keep their R&D tax credit claims strong.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch