Can you claim R&D Tax Relief for New Product Development (NPD)? A question with a complex answer when you consider how R&D is defined – however the short answer is ‘yes’, providing you have overcome a technical challenge to develop your new product!

New Product Development includes a wide array of activities, from initial technical and commercial research, design, prototyping, manufacture and commercialisation. The term can be used to describe the design of a completely new product, or the process of significantly updating an existing product.

Simply building a portfolio of new products doesn’t always make a business eligible for R&D Tax Relief for New Product Development. In order to qualify, a business must face significant technical challenges or uncertainties which generally means that they are attempting to create something new!

HMRC defines eligible R&D as:

“Activities that seek to:

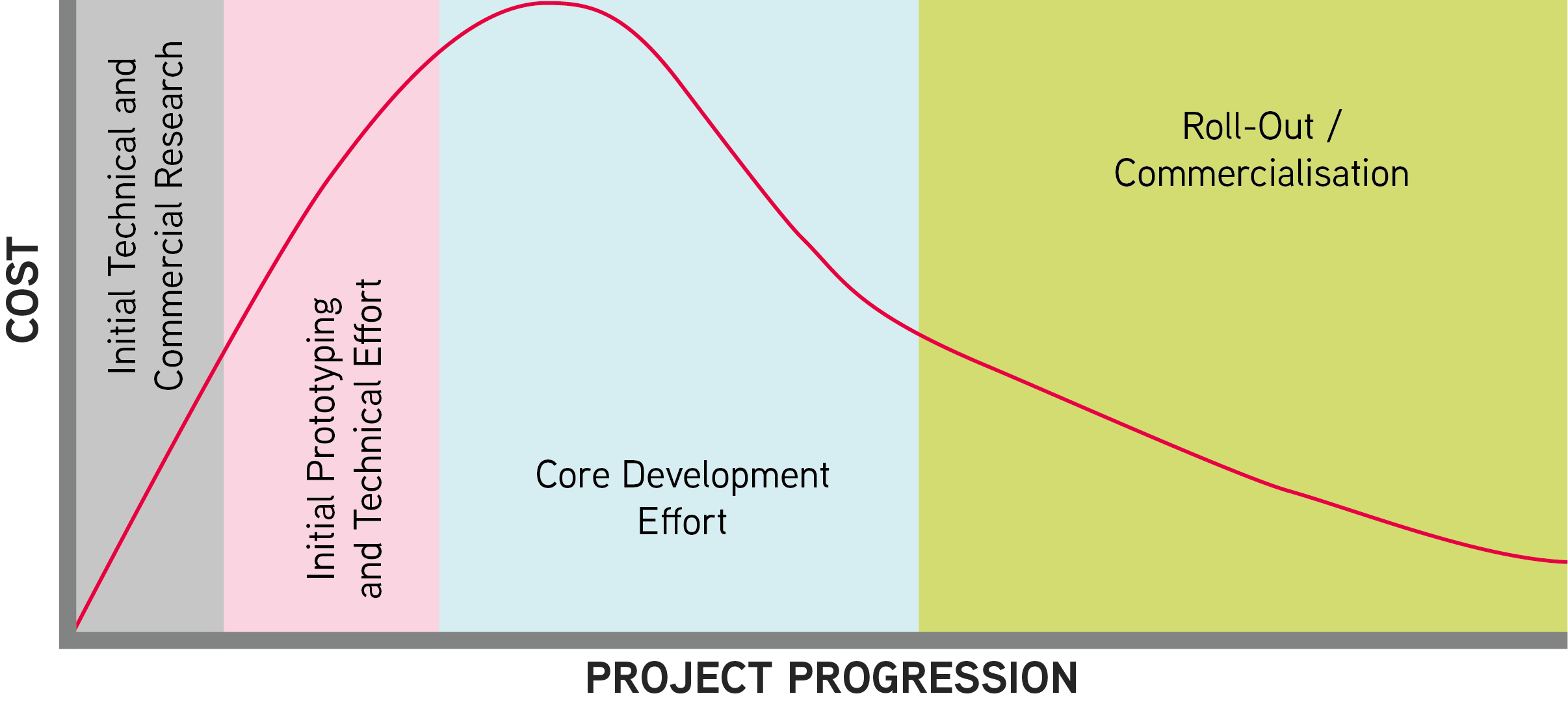

To explain which areas of NPD are eligible for R&D Tax Relief, we must look at a project lifecycle:

The curve on the above graph shows that there is likely to be some eligible R&D within each phase of the project lifecycle.

The ‘Initial Research’ phase includes eligible activities such as feasibility research and technical specification development, while the peak of eligible activities is within the ‘Prototyping and Technical Effort’ and ‘Core Development’ of a product. These phases include eligible R&D activities such as:

The commercialisation phase will involve some eligible R&D activities such as free field trials and product improvements, but unfortunately the majority of this phase will be ineligible as any marketing and sales activities cannot be included in a R&D Tax Credits claim.

Due to the HMRC definition of R&D activities, the aesthetic design and amendments of a new product are not considered eligible for a R&D Tax claim.

This also includes any aesthetic changes that are made to an existing product, in order to update or improve it, which can additionally be used to launch a ‘new and improved’ item.

Throughout the NPD process, there are multiple professional services required and their costs involved, which are unfortunately ineligible for a claim. These include:

Understanding the subtleties between eligible and ineligible R&D activities during new product development is a prime example of how an expert R&D Tax Credit Consultant can come in handy during your claim!

If you’re looking for additional help with your R&D Tax Relief for New Product Development, please contact us.