Medical R&D Tax Credits

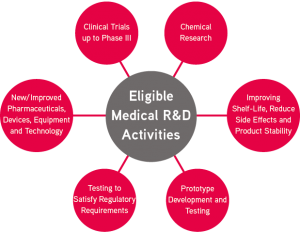

Within the medical sector, there is a continuous need for research and development (R&D). Whether it is for next generation medical devices, technologies and products, new and improved pharmaceuticals, or research into the use of genomics, AI or smart packaging; it is all R&D!

There is a large amount of funding available to the medical sector for R&D, but did you know that medical companies can also claim R&D tax credits for the work they are doing? They can even claim R&D tax relief if the company is loss making, if the project was unsuccessful and if the R&D was grant funded!

All of the above are examples of activities in the medical sector that are eligible for an R&D tax claim. As long as the R&D being done is to overcome a technical or scientific uncertainty, then it could be eligible!

Our Consultant’s are experts at delving deep into your R&D projects and identifying all of the eligible activity within them; making sure your claim is maximised to it’s fullest potential.

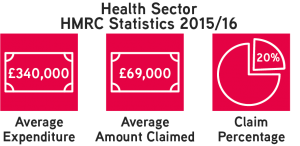

These statistics are based on 215 claims within the health sector in the financial year. Only 20% of the average expenditure is being claimed back, which we believe is far below what it should be!

Still not sure?

An R&D tax credit claim could be the cash injection needed to fund the next steps of the development journey! Use our R&D Tax Credit Calculator today to see how much you could potentially claim back!

Get in touch and our R&D Tax Credit Consultants can decipher from a FREE quick telephone consultation, whether the activities being undertaken are eligible and let you know exactly which project costs can be claimed back on.

Our comprehensive 2025 R&D Tax Credits review covers everything businesses need to know, including key developments in R&D tax reliefs, claim trends, compliance updates, HMRC enforcement actions, First Tier Tribunal cases, and changes to schemes like RDEC, ERIS, and Advance Clearance. Explore the impact on SMEs and large companies, insights on eligible costs and foreign subcontractor rules, and what to expect for R&D tax credits in 2026.

An HMRC R&D compliance check can be intimidating, even for businesses doing genuine innovation. This article walks you through what happens during a check, the information HMRC typically asks for, common issues that can arise, and how TBAT Innovation helps businesses respond confidently and keep their R&D tax credit claims strong.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch