Ian Davie

Senior Consultant

TBAT recently attended the July 2022 HMRC Research and Development Communications Forum meeting; in which, many changes to the UK’s R&D Tax Credit Schemes were discussed.

We’ve summarised the meeting below, to provide the latest information on the upcoming legislation changes, the legislation changes that are being considered, as well as the advice HMRC provided for submitting RDEC Scheme claims.

HMRC are making many reforms to the R&D Tax Credits schemes to prevent abuse of the schemes and also include additional qualifying cost categories to remain up to date with the latest science and technology advances.

The latest changes that will be implemented in April 2023 are:

Additionally, HMRC are also considering increasing the generosity of the RDEC Scheme – we believe this is due to the Corporation Tax rate increases; which would lower the amount of benefit received via the RDEC Scheme.

HMRC will be releasing a new Consultation to consider further areas of reform for the R&D Tax Credit schemes:

This consultation is open from 20th July 2022, and legislation should come into affect on these topics from April 2023.

HMRC confirmed that claims for the 2021-22 year have increased by 10.54% from the previous year, with 42073 SME claims and 6716 RDEC claims. HMRC paid 98% of these claims in 28 days.

Currently, due to HMRC’s ongoing investigation into irregular claims, their processing times are to 40 days temporarily. However, they’re working to decrease that back to 28 days within the next 2-3 weeks as they increase resources.

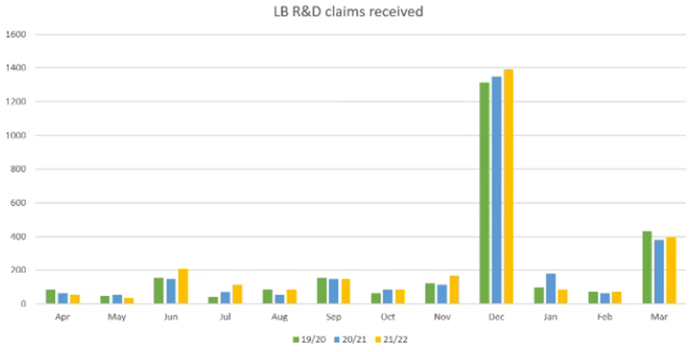

During the RDCF meeting, HMRC advised that they receive an extraordinary amount of claims submitted for the RDEC Scheme in December, as illustrated above. This of course is due to December year-ends, however, having such an increase in claims means that HMRC’s processing times are significantly affected.

To ensure swift processing of your claim, submit your RDEC claims in another month.

TBAT representatives attend the Research and Development Communication Forum meetings to receive the latest information on the R&D Tax Credit Schemes directly from HMRC. We do this to ensure we’re fully up to date with the updates and reforms so we can maintain our high standard of R&D Tax claims for our clients and inform our clients of upcoming changes.

The latest changes mentioned in this article are due to be implemented in April 2023 and some are measures taken to prevent abuse of the R&D Tax Credits Schemes.

The information that HMRC have provided regarding their processing times and when to submit Large Company claims via the RDEC Scheme is incredibly useful for us as advisors and to our clients.

We’re happy to discuss these reforms with anyone who would like to explore how the legislation changes will affect their future R&D Tax Credits claims – please contact us for a confidential discussion.

Not sure if your work counts for R&D tax relief? You’re not alone. We break down what HMRC means by Qualifying R&D Activities, with clear explanations, practical examples, and tips to help you avoid common mistakes. Whether you’re building something new or solving tricky technical problems, we’ll help you figure out what qualifies and how to make your claim count.

Claiming R&D Tax Relief for subcontracted work can be complex, especially with new rules from April 2024. This article explains what qualifies as subcontracted R&D, who can claim under the updated scheme, and what records you need to support your claim. From contracts and invoices to technical reports and emails, having the right documentation is key to staying compliant and avoiding HMRC enquiries.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch