Ian Davie

Senior Consultant

This article focuses on the unfavourable practices contributing to a negative perception of R&D tax agents. Consequently, it has prompted HMRC to contemplate methods of how they can better control the R&D tax claims being prepared, particularly through the less savoury end of the R&D tax agent industry.

To begin, it is important to acknowledge the presence of reputable firms that maintain integrity in their dealings with clients and potential clients. These firms refrain from engaging in dubious practices, prioritise honesty in their advice, and actively seek collaboration with HMRC to foster improvement. TBAT Innovation, for instance, falls within this commendable category. However, it is crucial to shed light on some of the poor marketing practices that draw companies to being poorly supported, making a false claim or being duped by misleading marketing.

One prevalent issue that frequently arises is the practice of cold calling. Directors, owners, finance managers, and R&D employees are bombarded with repeated calls throughout the week, all asking the same question: ““Have you claimed your R&D tax credits?”. Luckily nowadays, most of these calls are efficiently blocked by vigilant gatekeepers, but they still consume valuable time, and I have yet to encounter anyone who finds them beneficial. If you happen to engage with one of these calls and they attempt to persuade you that your projects are eligible for R&D claims, it is essential to seek a second or even third opinion. I have personally provided my perspective and clarified the reasons behind a project’s ineligibility, despite the assertion made by the cold caller that it was indeed eligible.

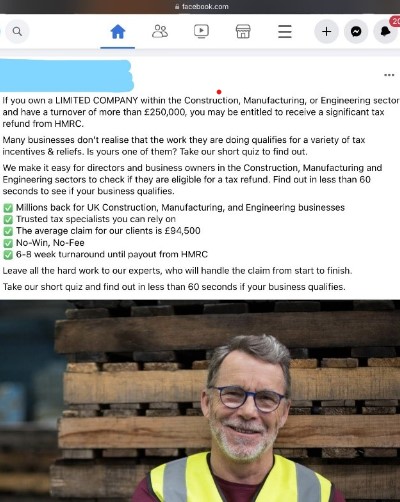

Have you ever come across a sponsored advertisement on Facebook or other social media platforms? I encountered one on June 19th that read, “Take this 60-second test to determine your eligibility for R&D tax credits.” To be honest, it is impossible to ask enough questions and evaluate eligibility within such a short timeframe. Curiosity led me to “complete” several of these tests, which provided answers indicating that I would not be eligible:

Do you have a registered company? NO

Are you developing new products? NO

Are you spending money on R&D? NO

Yet, astonishingly, they still claim I might be eligible and insist on having a conversation with me!

It is simply unrealistic to expect that a brief quiz lasting only 60 seconds can accurately assess a business’s qualification for R&D tax credits. It is crucial to engage in a conversation with a real person who can thoroughly evaluate and determine the potential eligibility of your claim.

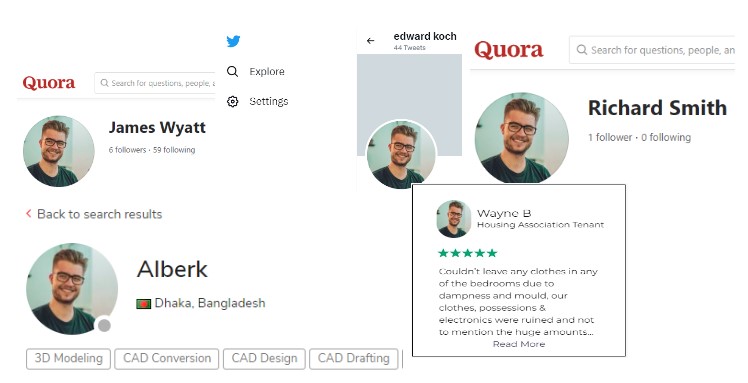

Case Studies are a great way to promote your company’s services and showcase your client. However, when examining these case studies, it’s crucial to question their authenticity. I have encountered several instances where it has been difficult to either find the company or verify the existence of the person featured, leaving me sceptical.

For instance, I encountered a case study page with quotes attributed to individuals, accompanied by their pictures. Upon attempting to find these individuals, I performed a Google search using their images, only to find uncertainty regarding their true identities. The names I came across that were attributed to these images were James Wyatt, Edward Kock, Richard Smith, Wayne B, and Alberk from Bangladesh. And I think you will agree, they cannot have been all these people! Upon further investigation, I learnt that two other case study images had the same problem, raising more doubts.

TBAT Case StudiesWhom are you engaging with within the company? When you choose to collaborate with a company, it is often based on their reputation, and you place trust in the individual you will be working with, believing they will perform their tasks competently. Take a moment to visit the company’s website and explore the individuals you might potentially interact with. Start by locating the company’s legal name for reference.

Essential information that should be on a website should include, as set out in ‘The Company, Limited Liability Partnership and Business (Names and Trading Disclosures) Regulations 2015’:

If the company will not tell you who they are, what are they hiding?

Once you have identified the company, it is important to inquire about the individuals comprising the organisation. People often engage with specific individuals within a company, as relationships are built between individuals. When it comes to R&D tax credits, it is a specialised field that requires both financial and technical expertise. Therefore, it is crucial to determine whether the company provides information about their team of experts. Is the company a faceless organisation, lacking transparency about the individuals behind their services?

Here is TBAT’s team : Meet The Team – TBAT

Do they have the skills necessary to understand your technology, evaluate it against baseline technology, determine the sought-after advancements, and ascertain whether it qualifies as R&D? Without support from technical experts, how can they realistically provide adequate assistance for your claim? Are they claiming difficult technical work will be enough to make a claim? Sectors such as construction, food and drink, and services are currently under scrutiny by HMRC, as they recognise the potential for R&D in these areas. However, HMRC is also scrutinising other sectors where they anticipate fewer claim submissions from companies.

Does the company claim to be HMRC approved or accredited or have a working relationship with HMRC? It is important to note that becoming an Agent and registering as such with HMRC does not equate to an official approval. Attending the 6-monthly R&D Communication Forum (RDCF) is a common practice for many firms, offering insights into upcoming developments, HMRC’s perspectives, and an opportunity to ask questions.

Currently, there is no accreditation process to become an R&D tax agent. You do not need technical qualifications nor financial qualifications, so companies that claim to be “Accredited Agents”, in this regard, are being deceitful.

HMRC is taking measures to enhance its understanding of which R&D agents are supporting R&D claims. Starting from August 1st, a new R&D Additional Information portal will be implemented, making it mandatory to disclose to HMRC the R&D agent that has provided support for a company’s R&D claim. Furthermore, to register as an Agent for this portal, the R&D agent must have an established and recognised certified Anti-Money Laundering (AML) scheme in place.

“100% success rate” is a phrase that is used, although it is discouraged. A reputable R&D agent may indeed achieve a 100% success rate by accurately assessing a company’s claim and only presenting eligible projects and costs. However, it is not a significant selling point that most reputable firms emphasise.

Is the company looking to charge high fees? I have come across companies with 30-35% fee rates, claiming they need to be high to cover the cost of HMRC Compliance Checks (Enquiries). If this is the case, it suggests that they have not adequately verified the R&D or effectively explained the technology to HMRC if they are willing to accept a high rate of enquiries. Such an offer is not beneficial to the client and can introduce significant difficulties.

During the sales phase, it is important to review the contracts. Are there cancellation fees associated with long-term contracts that bind you? As tax agents, they are legally obligated by the 5th Money Laundering Directive to conduct specific checks. If these checks are not carried out correctly, they are in violation of the law. Merely asking ““Have you ever laundered money?” is insufficient to meet the required standards.

I am passionate about supporting our clients and allowing them to make informed decisions, but it is crucial to be aware of deceptive marketing tactics employed by some R&D tax providers. Unfortunately, these practices have tarnished the reputation of the industry. They use flashy statements, exaggerated case studies, and oversimplification of requirements to lure unsuspecting clients. To protect yourself, do your homework, investigate their background, and always obtain multiple quotes and opinions! Most importantly, Trust your instincts and verify the facts before making any decisions.

Our comprehensive 2025 R&D Tax Credits review covers everything businesses need to know, including key developments in R&D tax reliefs, claim trends, compliance updates, HMRC enforcement actions, First Tier Tribunal cases, and changes to schemes like RDEC, ERIS, and Advance Clearance. Explore the impact on SMEs and large companies, insights on eligible costs and foreign subcontractor rules, and what to expect for R&D tax credits in 2026.

An HMRC R&D compliance check can be intimidating, even for businesses doing genuine innovation. This article walks you through what happens during a check, the information HMRC typically asks for, common issues that can arise, and how TBAT Innovation helps businesses respond confidently and keep their R&D tax credit claims strong.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch