Can the rail sector claim R&D Tax Credits?

TBAT are based in the East Midlands; we are at the centre of the rail industry with rail giants such as Bombardier, Network Rail and East Midlands Trains less than a 20-minute drive from our front door.

Our innovative rail clients work primarily in the rail supply chain and are undertaking R&D to stay at the cutting edge of the industry, which can take significant investment to develop their project/product; so what can they do to re-coup some of that cost to keep innovating?

R&D Tax Credits is the answer to that! By being able to claim back up to 33% of money spent on R&D, there is a huge amount of money available to rail companies to be able to reinvest in further R&D projects! Whether the project was funded by the company, through grant funding, or was sub-contracted work, there is the potential for a claim!

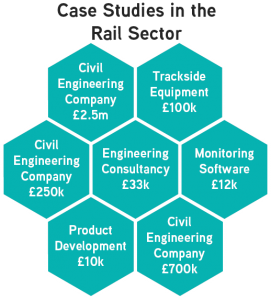

We have first-hand experience dealing with clients, of various sizes, in the rail industry and have helped identify and claim against their eligible R&D activities.

Through helping our clients, having technologists that have worked in the rail industry and through research of our own, we have put together some examples of eligible R&D activities within the rail sector…

This is just an example of some of the eligible activities identified! When considering whether R&D tax credits is the right thing for you, you need to consider one thing – are you working on something that has a technical/scientific challenge that could not have been overcome by a professional in the field? If the answer to that is yes, then chances are, your project and activities are eligible to claim against.

The rail industry is heavily regulated which leads to a lot of R&D going into ensuring that there is ongoing compliance – activities ensuring new products, processes, comply to regulations can alone make your work eligible to claim R&D Tax Credits!

TBAT’s consultants are experts in R&D Tax Credits and through a short FREE consultation, we can discuss your projects and tell you whether you have a claim! Get in touch today!

Not sure if your work counts for R&D tax relief? You’re not alone. We break down what HMRC means by Qualifying R&D Activities, with clear explanations, practical examples, and tips to help you avoid common mistakes. Whether you’re building something new or solving tricky technical problems, we’ll help you figure out what qualifies and how to make your claim count.

Claiming R&D Tax Relief for subcontracted work can be complex, especially with new rules from April 2024. This article explains what qualifies as subcontracted R&D, who can claim under the updated scheme, and what records you need to support your claim. From contracts and invoices to technical reports and emails, having the right documentation is key to staying compliant and avoiding HMRC enquiries.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch