Can the rail sector claim R&D Tax Credits?

TBAT are based in the East Midlands; we are at the centre of the rail industry with rail giants such as Bombardier, Network Rail and East Midlands Trains less than a 20-minute drive from our front door.

Our innovative rail clients work primarily in the rail supply chain and are undertaking R&D to stay at the cutting edge of the industry, which can take significant investment to develop their project/product; so what can they do to re-coup some of that cost to keep innovating?

R&D Tax Credits is the answer to that! By being able to claim back up to 33% of money spent on R&D, there is a huge amount of money available to rail companies to be able to reinvest in further R&D projects! Whether the project was funded by the company, through grant funding, or was sub-contracted work, there is the potential for a claim!

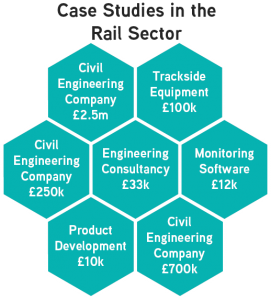

We have first-hand experience dealing with clients, of various sizes, in the rail industry and have helped identify and claim against their eligible R&D activities.

Through helping our clients, having technologists that have worked in the rail industry and through research of our own, we have put together some examples of eligible R&D activities within the rail sector…

This is just an example of some of the eligible activities identified! When considering whether R&D tax credits is the right thing for you, you need to consider one thing – are you working on something that has a technical/scientific challenge that could not have been overcome by a professional in the field? If the answer to that is yes, then chances are, your project and activities are eligible to claim against.

The rail industry is heavily regulated which leads to a lot of R&D going into ensuring that there is ongoing compliance – activities ensuring new products, processes, comply to regulations can alone make your work eligible to claim R&D Tax Credits!

TBAT’s consultants are experts in R&D Tax Credits and through a short FREE consultation, we can discuss your projects and tell you whether you have a claim! Get in touch today!

Our comprehensive 2025 R&D Tax Credits review covers everything businesses need to know, including key developments in R&D tax reliefs, claim trends, compliance updates, HMRC enforcement actions, First Tier Tribunal cases, and changes to schemes like RDEC, ERIS, and Advance Clearance. Explore the impact on SMEs and large companies, insights on eligible costs and foreign subcontractor rules, and what to expect for R&D tax credits in 2026.

An HMRC R&D compliance check can be intimidating, even for businesses doing genuine innovation. This article walks you through what happens during a check, the information HMRC typically asks for, common issues that can arise, and how TBAT Innovation helps businesses respond confidently and keep their R&D tax credit claims strong.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch