Chris Stuttle

Senior Consultant

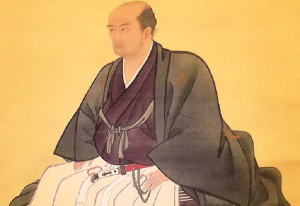

Hanaoka Seishū, born 23rd October 1760 in Japan, is one of the fathers of modern surgery and general anaesthesia. Although many of his discoveries during the 19th century went unnoticed because of Japan’s national isolation policy, his works and innovations are credited to him within the modern field of medicine. He is attributed with the accolade of being the first surgeon to operate while his patient was under general anaesthesia. When Hanaoka Seishū made these discoveries there were no R&D Tax Credits, but here we have a little fun and ask: “how could R&D Tax Credits have helped?”

General anaesthesia has its roots in the ancient empires of the Sumerians, Babylonians, Assyrians, Egyptians, Greeks, Romans, Indians, and Chinese. Within these early forms of pain reduction and sedation, around 3400 BC, the main active ingredients were rooted in opium and alcohol – leading to dangerous and very painful results. It was said that surgery was a last resort, with people opting to rather face death than go through the trauma of the surgeon’s knife.

Hanaoka Seishū’s work was heavily influenced by traditional Japanese and Chinese medicine as well as the newly Dutch-imported European surgery. His work with traditional medicine attempted to recreate and improve the work of Hau Tuo, a Chinese surgeon from the 2nd century AD who had developed “mafeisan powder” that, when mixed with wine, induced a state of unconsciousness and partial neuromuscular blockade. But, as with all good mysteries, the ancient recipe was lost when he burned his work, leaving Hanaoka Seishū with a significant challenge.

It was during his initial investigations that Hanaoka Seishū contacted TBAT Innovation regarding his current research. Although it was very surprising, Hanaoka Seishū had set up a Limited company in the UK and had been paying for work nationally and internationally through this UK base. After educating Hanaoka Seishū to the ‘magic’ of online video meetings, TBAT Consultants were able to assess most of the eligible expenditure that could be claimed by R&D Tax Credits. One such item identified as eligible was his clinical trials a year before, which tragically caused his wife to go blind.

Following many communications, it was clear that face-to-face meetings were needed to be held to collect all the technical information for the evidence report which was needed. Hanaoka Seishū was aware that other consulting companies were available, but he was shocked to see the lack of depth in their example reports and that the information for these reports demanded that he write significant sections himself. TBAT Innovation relieved these fears because their process involved having face-to-face meetings to capture the technical side of the claim and that their technical reports are the best in the business because of the highly qualified individuals doing the thorough reports. Therefore, considering the Japanese-English language barrier and the benefit of undertaking face-to-face technical conversations in the location where the work was being done, he chose TBAT Innovation to undertake his important R&D Tax Claim. He even said, “TBAT Innovation must be ideally placed in the centre of the UK to reach anyone wanting a great R&D Tax Claim.”

TBAT Innovation were happy to send two of their senior consultants to Japan to meet with Hanaoka Seishū and his team, spending several days having meetings with technically like-minded developers. From this multitude of meetings, a comprehensive technical report was created which fully explained to HMRC the costs and work being undertaken with the UK based part of the company and how they were eligible under current legislation.

From this claim there were significant savings in tax and even a cash reimbursement from HMRC. Hanaoka Seishū could spend this money however he liked, deciding to reinvest these savings into his UK based Limited company.

Interested in how much you could claim back in R&D Tax Credits? Use our FREE and easy to use online Tax Calculator to estimate your potential claim!

If you require anymore information on R&D activities that could be eligible, our consultants are experts in identifying qualifying work – get in touch today for a consultation!

Our comprehensive 2025 R&D Tax Credits review covers everything businesses need to know, including key developments in R&D tax reliefs, claim trends, compliance updates, HMRC enforcement actions, First Tier Tribunal cases, and changes to schemes like RDEC, ERIS, and Advance Clearance. Explore the impact on SMEs and large companies, insights on eligible costs and foreign subcontractor rules, and what to expect for R&D tax credits in 2026.

An HMRC R&D compliance check can be intimidating, even for businesses doing genuine innovation. This article walks you through what happens during a check, the information HMRC typically asks for, common issues that can arise, and how TBAT Innovation helps businesses respond confidently and keep their R&D tax credit claims strong.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch