Ian Davie

Senior Consultant

Navigating the Impending Merger: Comprehensive Insights into the Combined R&D Tax Relief Schemes

The recent Autumn Statement officially announced the merger of the R&D tax relief schemes, scheduled to take effect from 1st April 2024, for accounting periods starting after this date. This significant reform, following a consultation opened in January 2023 and subsequent policy papers, particularly impacts companies engaged in Research and Development (R&D) activities.

The supporting documentation, released shortly after the Autumn Statement, outlines the groundwork for combining the Small and Medium Enterprise (SME) and Research and Development Expenditure Credit (RDEC) schemes. This impending merger, affecting all claiming companies, prompted our comprehensive analysis of the associated rules.

Confirmed in the Autumn Statement on 22nd November, the merger will follow RDEC rules, highlighting the role of R&D in a company’s pre-tax income. Larger businesses accustomed to the RDEC scheme’s ‘above-the-line credit’ approach may experience a smoother transition, while SMEs are advised to proactively plan for the impending changes.

Key Components of the Merged Scheme:

Already announced:

In the earlier spring statement and previous announcements, the Government had already added in maths and cloud–computing costs as eligible and that overseas sub-contractor costs would become ineligible unless the R&D has to take place abroad for geographical, social or legal reasons.

Impact on Businesses:

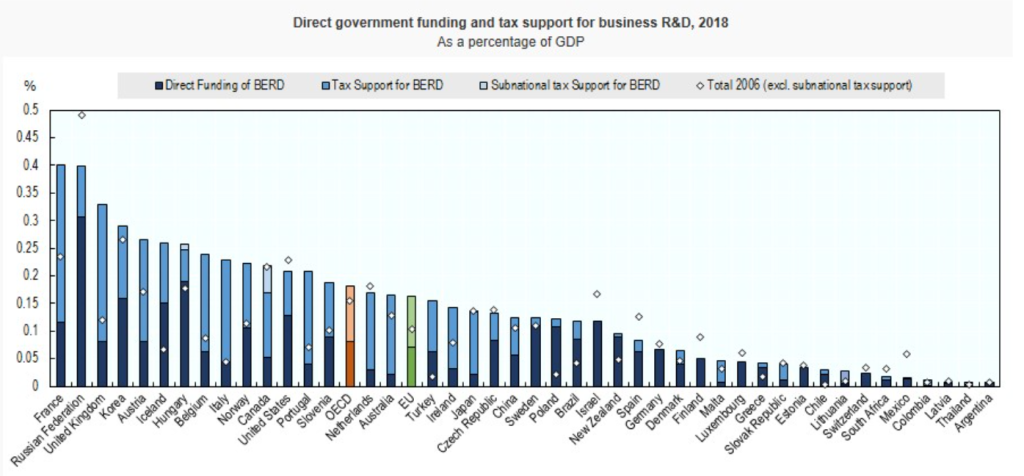

The merger has broad implications for companies involved in R&D activities, potentially reducing benefits for smaller enterprises. Noteworthy changes to rules on R&D decision makers, subsidised R&D and overseas costs necessitate careful planning, especially for businesses receiving grants or contracts for sub-contracted R&D. The increased benefit rate for the RDEC scheme to 15-16% is a significant boost for Large Companies but will this be competitive enough among international schemes where some countries offer the following benefit#:

For the SME in the UK the benefit has dropped from 25-33% to 15-27%, a significant hit and again does this make the UK an attractive place to carry out R&D, especially when HMRC are being quite aggressive in challenging R&D claims made by SMEs.

How to prepare:

Contrary to expectations of a potential one-year delay, the Autumn Statement confirmed the merger’s timely implementation. Businesses, especially SMEs, are urged to be proactive in readiness for potential changes. We welcome inquiries for advice, offering assistance in evaluating impacts, resource sourcing, contract terms and recommending necessary organisational adjustments.

Government’s Objectives:

The government’s objective is to make the UK a world leader in R&D as a driver of innovation and economic growth. The merged scheme aligns with their goal of tax simplification and prudent use of taxpayers’ money.

Graph source – New data on R&D Tax Incentives from OECD

Our comprehensive 2025 R&D Tax Credits review covers everything businesses need to know, including key developments in R&D tax reliefs, claim trends, compliance updates, HMRC enforcement actions, First Tier Tribunal cases, and changes to schemes like RDEC, ERIS, and Advance Clearance. Explore the impact on SMEs and large companies, insights on eligible costs and foreign subcontractor rules, and what to expect for R&D tax credits in 2026.

An HMRC R&D compliance check can be intimidating, even for businesses doing genuine innovation. This article walks you through what happens during a check, the information HMRC typically asks for, common issues that can arise, and how TBAT Innovation helps businesses respond confidently and keep their R&D tax credit claims strong.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch