Matt Symonds

Director

In the 2021 Budget, the chancellor highlighted that Innovation and technological progress are central to driving long-term growth and improved living standards, as evidence shows that countries with higher Research and Development (R&D) activity tend to have higher productivity.

Science and innovation will continue to underpin solutions to many of the world’s greatest challenges, from economic recovery to climate change, health emergencies and national security. Every pound the government spends on R&D stimulates, on average, around £2 of private investment. Firms participating in UK Research and Innovation funded projects have been shown to grow employment and sales around 25% faster over six years than comparable firms.

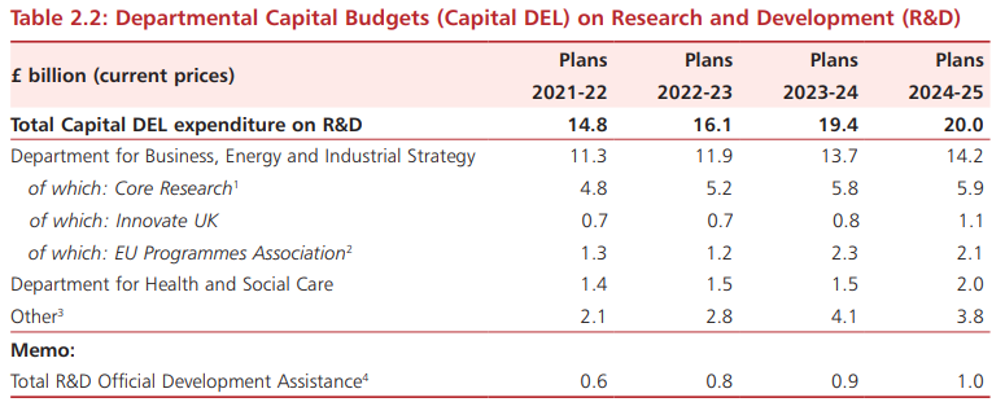

The UK starts from a position of strength, ranking fourth in the Global Innovation Index, is home to four of the top 20 universities globally, and has the second-most Nobel laureates of any nation. However, Gross Expenditure on R&D in the UK in 2019 was 1.8% of GDP, lower than other advanced economies and below the OECD average of 2.5%, a trend primarily driven by low business investment in R&D. To address this, the government is increasing public R&D investment to record levels, providing £20 billion across the UK by 2024-25, including funding for EU programmes, to cement the UK as a global science and technology superpower. This is an increase of around a quarter in real terms: the largest ever over an SR period.

Combining the government’s direct spending on R&D with the support for tax relief, total UK R&D support as a proportion of GDP is forecast to increase from 0.7% in 2018 to 1.1% in 2024-25. This is well above the latest OECD average of 0.7%. For Germany the figure is 0.9%, for France 1%, and for the US 0.7%.

The Budget and SR will support the UK’s world-leading research base, while also ensuring that businesses across the UK have access to the ideas, skills and finance they need to grow, driving increased productivity and leveraging in further private investment. This settlement will make significant progress towards the government’s ambition to increase R&D spending to £22 billion by 2026-27, and drive economy-wide R&D investment to 2.4% of GDP in 2027.

Matt Symonds, Managing Director of TBAT Innovation says “From a UK research and development perspective, this would appear to be a very positive budget, that stimulates, supports and encourages further innovation in the UK, which is great to see. Following Brexit and given COVID, we were looking for commitment to drive innovation and encourage activity in the UK, and we hope the measures announced enable this. We now look forward to further detail and will obviously keep you posted accordingly”

Review the latest Grant Funding opportunities on our Grant Funding Finder, or use our R&D Tax Calculator for a ball-park figure on how much R&D Tax Relief you could receive from HMRC. Our expert consultants are available to discuss your project idea in detail and help you access the funding you need, simply get in touch.

Oxford-based startup A&B Smart Materials has raised an oversubscribed £1.5M Pre-Seed round to accelerate the development of fully biodegradable superabsorbent polymers for hygiene and agricultural applications. Winner's of the 2025 TBAT Innovation Challenge, the company is tackling the growing environmental impact of synthetic SAPs while targeting a global market projected to reach $17 billion by 2035.

TBAT Innovation has been recognised as Highly Commended in the Growth Innovation Champion category at the 2025 Innovation Awards. The commendation highlights the growing impact of the TBAT Innovation Challenge – TBAT’s flagship initiative supporting innovation-driven UK SMEs.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch