Ian Davie

Senior Consultant

Compared with previous years, the world of R&D and tax credits has been relatively stable over the past year. Prior years saw changes in schemes, rates, eligible costs, and an increasingly assertive HMRC trying to get to grips with an £8 billion tax credit beast and a consultancy sector that had stretched the rules. This review considers the developments and changes that occurred, or that featured prominently in the news.

In late 2024, HMRC took major enforcement action against Green Jellyfish, an R&D tax provider founded in 2019, including a raid on its premises in October, as reported by the BBC. In February 2025, the BBC further reported that several companies linked to the group, under the directorship of Mark Robinson and Steve Christophi were being wound up. Investigations into alleged tax relief fraud and money laundering remain ongoing under the Fraud Act 2002, the Corporation Tax Act 2010, and the Criminal Finances Act 2017. The collapse has reportedly left employees owed around £600,000 in unpaid wages, and HMRC pursuing approximately £2.5 million in unpaid taxes.

Separately, The Times reported that 28 football clubs had claimed R&D tax relief intended for technology-led innovation, raising questions about the scope of the scheme, including the treatment of players’ salaries. One claim, supported by R&D adviser ZLX for Dundee United, reportedly resulted in £1.4 million of relief. ZLX was also linked to an attempted claim for installing an industrial fridge, which was abandoned when the client determined it did not qualify as R&D, ZLX then sued the company for their invoice and lost.

HMRC launched the R&D Tax Relief Advance Clearance Consultation to replace the restrictive and rarely used R&D Advance Assurance scheme. The consultation sought views on widening the use of advance clearances in the R&D reliefs. Advance assurance or clearances aim to provide a degree of pre-approval of R&D, though in both cases, the company would still need to apply for the R&D tax relief annually. The current scheme is limited to first-time SME claimants with turnover under £2 million, fewer than 50 employees, and part of a group, meaning very few companies qualify.

Between 2020 and 2024, several key First Tier Tribunal (FTT) cases clarified the boundaries of R&D tax claims and HMRC’s interpretation. Quinn vs HMRC confirmed that some subsidised projects could be claimed under both SME and RDEC schemes. Other cases, including RealBuzz Ltd vs HMRC, helped define issues around competent professionals, trading status, use of advisers, and careless inaccuracies.

Read our ‘Summary of Tribunal Decision: Realbuzz Group Ltd v HMRC’ article

From 1st April, the New RDEC and ERIS schemes came into effect for accounting periods starting after that date. This differed from earlier rate or scheme changes, which took effect on a set date, such as the rate changes introduced on 1st April 2023. The new design aims to simplify claims: all companies now claim under the New RDEC, regardless of size or project type, while ERIS provides enhanced support for early-stage loss-making SMEs at a 27% rate (down from 33% under the old SME scheme). The changes also introduced new rules on who can claim for R&D and foreign subcontractor costs.

Contemplated R&D arises when two companies collaborate, with one either subcontracting eligible R&D from a client or hiring a supplier to carry out eligible R&D. The rules for qualifying R&D remain the same, but eligibility depends on factors such as IP ownership, who manages and explains the R&D, and which party bears the financial risk.

From 1st April 2024, foreign subcontractor costs are generally ineligible unless needed for environmental, legal, or regulatory reasons, or if UK capacity is insufficient and upgrading it would be unreasonable. HMRC aims to focus R&D claims on UK-based costs.

Every six months, HMRC holds the Research & Development Communication Committee (RDCC) with R&D tax providers. This was the first partly in-person meeting in London since COVID, and I was lucky to get a seat at the table, one of about 32 in the room, with over 100 joining online. It’s a chance to hear HMRC’s latest stats, initiatives, and plans for R&D tax relief. Being there in person made the discussions much better, and I managed to ask a couple of questions. There was significant focus on the new HMRC Advance Clearance, set to replace the largely ineffective Advance Assurance process.

Claim Notification Forms (CNFs) were introduced on 1 April 2023, requiring companies that have never claimed, or not claimed in a defined three-year period, to submit a CNF before claiming R&D relief. In May, HMRC updated its guidance after errors in the original version had caused some companies to lose claims, clarifying the circumstances under which claims could still be made.

Read our ‘The Crucial Role of the Claim Notification Form in R&D Tax Relief’ article

R&D tax advisor Thomas Elsbury suspected HMRC was using AI in its correspondence. After a December 2023 Freedom of Information request was refused, he launched a First Tier Tribunal case, Thomas Elsbury vs The Information Commissioner – Information Rights. The FTT ruled that HMRC’s refusal to provide information reinforced concerns about AI use, potentially undermining trust in its handling of claims. The appeal succeeded, and HMRC was given time to respond to the Freedom of Information request, which was finally issued in October.

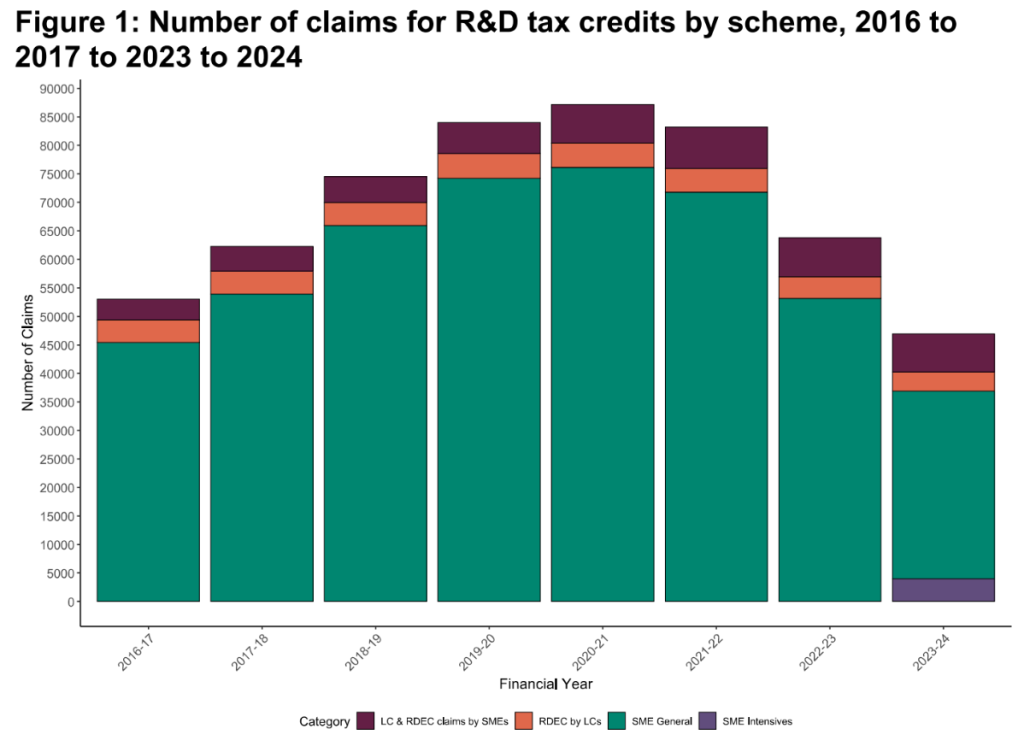

HMRC published updated R&D tax credit statistics to March 2024, though many recent scheme changes, including the April 2023 rate changes, are not yet fully reflected. The impact of the Mandatory Random Enquiry Programme (MREP), on which HMRC’s R&D compliance check plan is built, is beginning to show. Sector and regional trends remain largely unchanged, with Information & Technical, Manufacturing, and Professional, Scientific & Technical leading by volume and value, and London and the South East accounting for 39% of claims and 51% of total value.

The biggest shift is in the number of companies claiming, dropping to the lowest number since before 2016. The majority of which is heavily skewed towards the number of SMEs claiming, with an overall drop 31%. First-time claimants dropped significantly, with 7230 SMEs and 2000 for Large Companies (LCs). This is nearly half the level of 2016/17, likely reflecting the impact of HMRC’s MREP and increased scrutiny of non-compliant R&D agents.

Read our ‘Is HMRC’s MREP reducing R&D Tax Relief errors and fraud?’ article

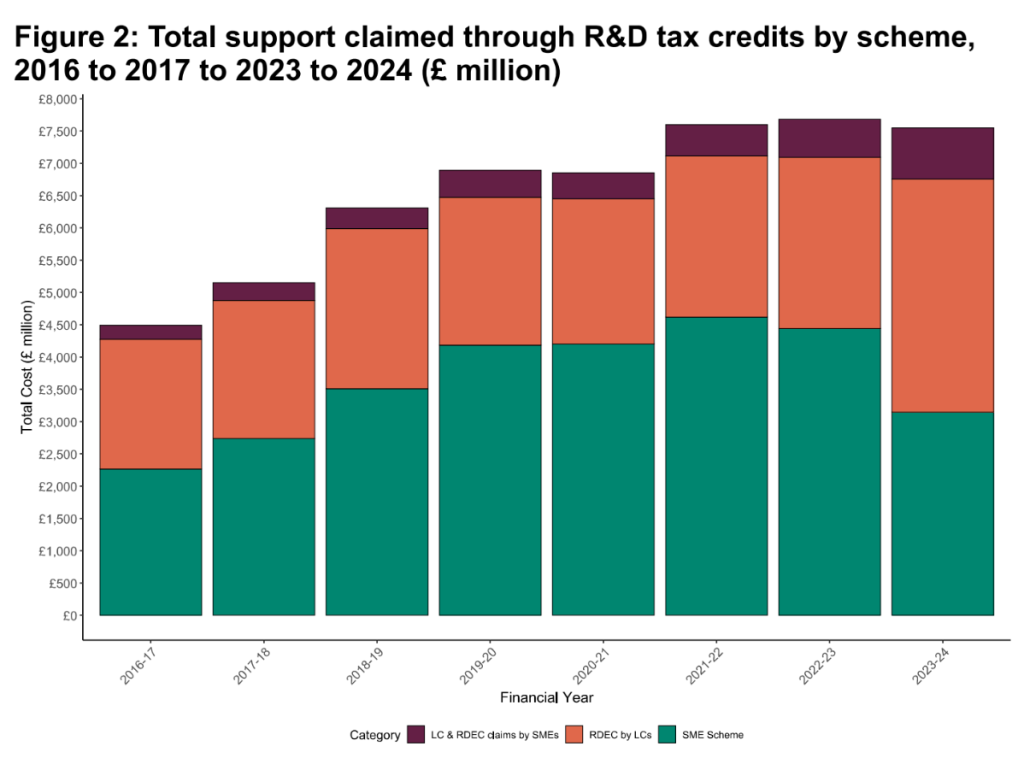

Despite the drop in the number of claimants, the support being claimed through R&D tax relief is staying static.

SME claimant numbers fell sharply, but so did the benefit level change for the period, from a previous 130% uplift to 86%. At the same time, the RDEC rate increased from 13% to 20%, driving higher RDEC values for SMEs and large companies. Overall R&D expenditure remained static at £46.1 billion, down just 1% year on year.

The significance here is that, despite fewer claims in 2023/24, total R&D spend remained the same, pushing the average eligible spend per claim up to £981k (46,950 claims on £46.1b spend), compared with £732k in 2022/23 (63,780 claims on £46.7b spend). Claims over £1 million increased by 8% in number but 21% in value, while all smaller cost bands declined. The reasons for this shift are unclear.

A software provider to R&D tax advisers identified certain SIC codes that HMRC views as less likely to involve R&D, increasing the risk of compliance checks. This does not mean R&D cannot occur in those SIC codes, but claims may require clearer explanation. As SIC codes are used by HMRC for risk assessment, keeping them up to date at Companies House is good practice.

Separately, DSIT confirmed a £55 billion funding boost to UK R&D funding through to 2030, supporting sectors such as health, security, quantum, robotics, AI, and clean energy via UK research agencies and bodies including UKRI.

Following Thomas Elsbury’s Freedom of Information request and subsequent FTT case, HMRC released some information: “Large Language Model (LLM) or generative AI was not used by the R&D Tax Credits Compliance Team as part of work on R&D tax relief claims, and this technology was not approved for use in generating taxpayer letters. In addition, at the time of the request, there were no planned expansions or changes to the use of AI or LLMs in R&D compliance.”.

HMRC added that since December 2023, it has expanded its use of generative AI in other compliance areas, such as document analysis and debt risk prediction, and confirmed limited testing of an internal R&D summarisation tool in mid-2024.

The National Audit Office’s annual review of HMRC included limited reference to R&D tax reliefs, mainly through headline figures. For April 2024 to March 2025, Corporation Tax Reliefs total £10.12 billion, including £7.6 billion for R&D and £2.4 billion for creative reliefs. HMRC’s latest published R&D figure for 2023/24 (released in September) was £7.55 billion, indicating continued growth in the scheme, with 2024/25 already exceeding the prior year, subject to later adjustments.

The Office for National Statistics (ONS) published its Business, enterprise research and development, UK 2024 report, showing business R&D spend of £55.6 billion, up 4.5% year on year. Software development was the largest category at £10.3 billion, with London leading by value at £13.3 billion. Given recent disruption to R&D reliefs, leading up to and into 2024, a 4.5% increase in overall spending of R&D is healthy.

The Autumn Budget was largely quiet on R&D tax reliefs, allowing a period of stability for the sector. The main announcement was that all tax advisers will be required to register with HMRC from 1st April 2026. Since the announcement, this has been pushed back to 1st May 2026. This aims to give HMRC greater oversight of tax advisor activities and increased enforcement powers. A pilot for R&D advance clearance was also announced, though with limited detail on its operation or scope.

UKRI outlined plans to invest a record £38.6 billion over four years, including the following:

The NAO also published its 2024/25 review of the Department for Science, Innovation & Technology (DSIT), which funds major R&D programmes including UKRI, ESA, and Horizon Europe.

2025 was a relatively quiet year for R&D tax reliefs, but the wider R&D environment remains strong and well supported. Few changes are expected in 2026, aside from Tax Adviser registration and the Advance Clearance process. These measures won’t affect the core scheme or support for R&D businesses but will increase oversight of providers and offer greater certainty for companies, which is positive.

If you’d like to discuss any of the developments highlighted in this article, please book a free consultation. TBAT Innovation can walk you through the recent changes, explain how they might impact your R&D claims, and offer practical guidance to ensure your business is making the most of the available reliefs. Whether it’s understanding new compliance requirements, navigating the Advance Clearance process, or optimising your R&D strategy, we’re here to provide clear, tailored advice.

An HMRC R&D compliance check can be intimidating, even for businesses doing genuine innovation. This article walks you through what happens during a check, the information HMRC typically asks for, common issues that can arise, and how TBAT Innovation helps businesses respond confidently and keep their R&D tax credit claims strong.

HMRC is increasing its scrutiny of R&D tax credit claims, with more businesses receiving compliance enquiries months after submission. Understanding why HMRC enquiries are rising, and how to respond, can help businesses protect their R&D claims and reduce disruption. Learn what triggers HMRC R&D enquiries, what HMRC expects, and how to ensure your claim is protected.

Assists organisations in accessing research and development grant funding across a range of UK and EU schemes and industry sectors.

Get In Touch